Minimum payments mean costly consequences chapter 4 lesson 1 – In this lesson, we delve into the significant financial implications of making only the minimum payments on debts. We’ll explore the long-term consequences, the impact on credit scores, and the cycle of debt that can result from this practice. Additionally, we’ll discuss alternatives to minimum payments and the benefits of making more than the minimum, highlighting real-life examples of positive financial outcomes.

Minimum Payments Mean Costly Consequences

Making only the minimum payments on debts can have severe long-term financial consequences. This practice leads to higher interest charges, longer repayment periods, and damage to credit scores, creating a cycle of debt that can be difficult to break free from.

The True Cost of Minimum Payments, Minimum payments mean costly consequences chapter 4 lesson 1

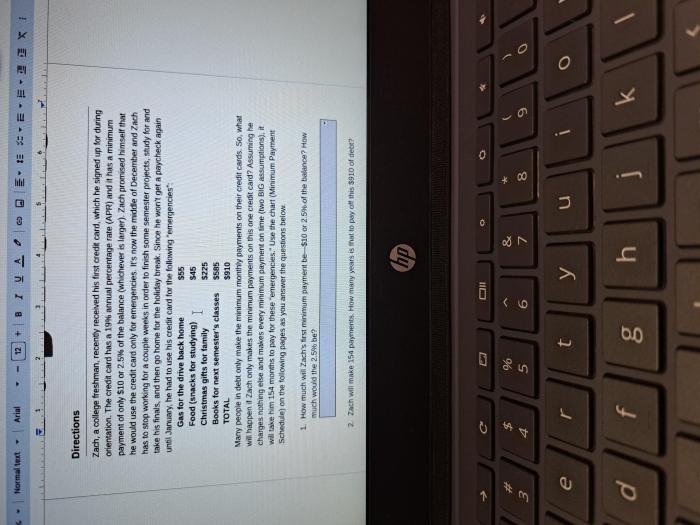

When you make only the minimum payment on a debt, you pay the least amount required each month. This covers the interest charges and a small portion of the principal balance. However, the majority of your payment goes towards interest, meaning it takes longer to pay off the debt and you end up paying more in the long run.

For example, if you have a credit card balance of $1,000 with an interest rate of 18%, making only the minimum payment of $25 per month will take you 55 months to pay off the debt. During that time, you will have paid a total of $1,375 in interest.

The Impact on Credit Scores

Making only minimum payments can also negatively impact your credit score. Credit scores are used by lenders to assess your creditworthiness and determine your eligibility for loans and credit cards. Missed or late payments can damage your credit score, reducing your access to future credit and increasing the interest rates you pay on future loans.

Expert Answers: Minimum Payments Mean Costly Consequences Chapter 4 Lesson 1

What is the true cost of minimum payments?

Making only the minimum payments on debts can lead to higher interest charges and longer repayment periods, resulting in significant additional costs over time.

How do minimum payments impact credit scores?

Missed or late payments due to minimum payments can damage credit scores, reducing access to future credit and potentially leading to higher interest rates on loans.

What are the alternatives to minimum payments?

Strategies for making more than the minimum payments include budgeting techniques, debt consolidation options, and credit counseling services.