Discover the ngpf analyze overdraft fees answer key, an authoritative resource that empowers you to understand the intricacies of overdraft fees, their impact, and strategies to mitigate them. This comprehensive guide provides insights into the National Governors Association’s analysis, legal considerations, and best practices for consumers.

Overdraft fees can be a significant financial burden for individuals and families. The ngpf analyze overdraft fees answer key delves into the extent of these fees, their consequences, and the actions taken by banks and credit unions to address this issue.

By understanding the key findings of the NGA’s report, consumers can make informed decisions to avoid or minimize overdraft fees.

Overdraft Fees and Their Impact

Overdraft fees are charges imposed by banks and credit unions when a customer’s account balance falls below zero. These fees can range from $25 to $35 per overdraft, and they can add up quickly if a customer overdraws their account multiple times.

Overdraft fees can have a significant impact on individuals and families, as they can lead to additional debt, damage to credit scores, and even bank account closures.

Analysis of Overdraft Fees by the National Governors Association (NGA): Ngpf Analyze Overdraft Fees Answer Key

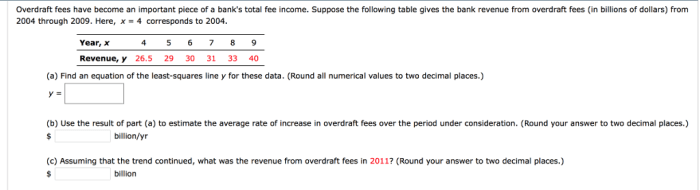

In 2017, the National Governors Association (NGA) conducted an analysis of overdraft fees. The report found that overdraft fees are a major source of revenue for banks and credit unions, generating billions of dollars in fees each year. The report also found that overdraft fees disproportionately impact low-income and minority consumers.

Key Findings of the NGA’s Report

- Banks and credit unions collected $34 billion in overdraft fees in 2016.

- The median overdraft fee was $34.

- Overdraft fees are more likely to be charged to low-income and minority consumers.

- Overdraft fees can lead to a cycle of debt.

Methods for Reducing Overdraft Fees

There are a number of strategies that banks and credit unions can implement to reduce overdraft fees. These strategies include:

Offering Overdraft Protection

Overdraft protection is a service that allows customers to link their checking account to a savings account or line of credit. If the customer’s checking account balance falls below zero, the bank or credit union will automatically transfer funds from the linked account to cover the overdraft.

Waiving Overdraft Fees for Small Overdrafts

Some banks and credit unions waive overdraft fees for small overdrafts, such as those under $5.

Limiting the Number of Overdraft Fees per Month

Some banks and credit unions limit the number of overdraft fees that a customer can be charged per month.

Providing Financial Education

Banks and credit unions can provide financial education to their customers to help them understand how to avoid overdraft fees.

Legal and Regulatory Considerations

Overdraft fees are regulated by a number of laws and regulations. These laws and regulations include:

The Truth in Lending Act (TILA), Ngpf analyze overdraft fees answer key

TILA requires banks and credit unions to disclose the terms and conditions of their overdraft services to their customers.

The Electronic Fund Transfer Act (EFTA)

EFTA prohibits banks and credit unions from charging overdraft fees on ATM withdrawals and debit card transactions unless the customer has opted in to overdraft protection.

The Dodd-Frank Wall Street Reform and Consumer Protection Act

Dodd-Frank gives the Consumer Financial Protection Bureau (CFPB) the authority to regulate overdraft fees.

Best Practices for Consumers

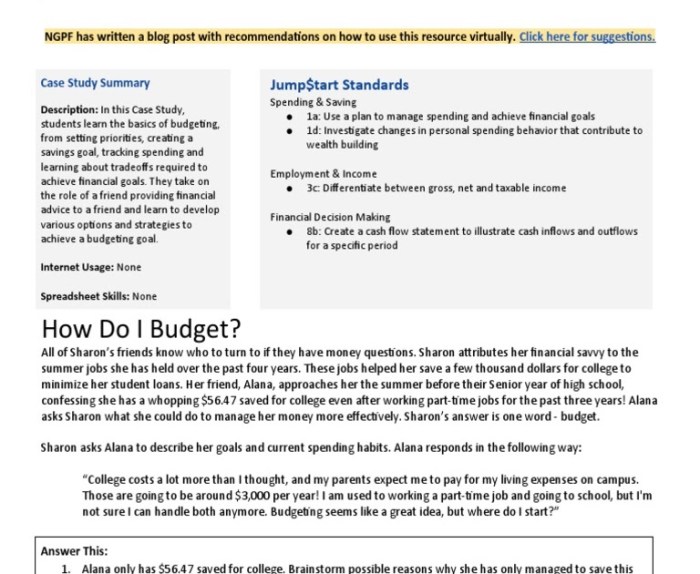

There are a number of things that consumers can do to avoid or minimize overdraft fees. These tips include:

Track Your Spending

Keeping track of your spending can help you avoid overdrawing your account.

Set Up Overdraft Protection

Overdraft protection can help you avoid overdraft fees by automatically transferring funds from a linked account to cover overdrafts.

Use a Debit Card Instead of a Credit Card

Debit cards deduct money directly from your checking account, so you cannot overdraw your account with a debit card.

Contact Your Bank or Credit Union

If you are facing overdraft fees, contact your bank or credit union to see if they can waive the fees or provide you with a payment plan.

General Inquiries

What is an overdraft fee?

An overdraft fee is a charge imposed by a bank or credit union when an account holder spends more money than they have available in their account.

How can I avoid overdraft fees?

There are several strategies to avoid overdraft fees, such as setting up overdraft protection, linking your account to a savings account, or using a prepaid card.

What are the legal considerations surrounding overdraft fees?

Overdraft fees are regulated by federal and state laws. The Dodd-Frank Wall Street Reform and Consumer Protection Act limits the number of overdraft fees that banks can charge per day.